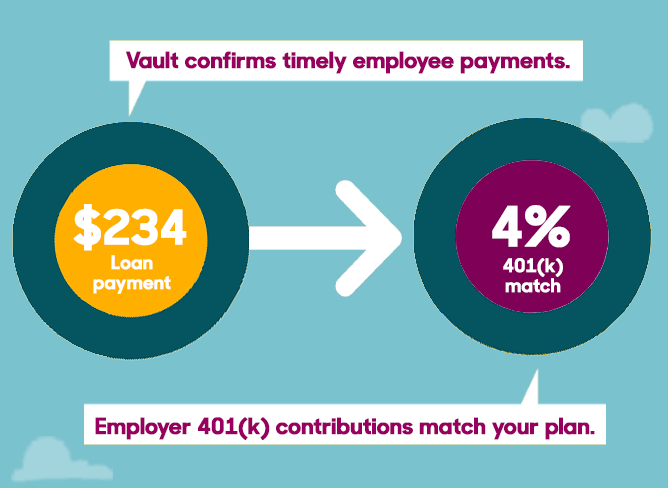

As part of SECURE Act 2.0 employee benefits addition, Match is our newest, easy-activation student loan benefits product. Employees no longer need to choose between making contributions to their retirement plans or paying down their student loans. When Vault Match is offered to employees, employers can reward timely student loan payments by making a matching contribution to an employee's established retirement plan.

Vault´s fully-configurable platform lets employers and employees realize the tax advantages offered to both in the passage of the SECURE Act 2.0. Employers have chosen to reward employees who make their student loan payments by contributing an employer match into eligible employee 401(k) and retirement accounts.

Learn more

We´ll help you match participants’ 401K contributions by assuring they meet eligibility outlined in your plan sponsor program design.

Vault employers have received tax advantages and increased employee tenure by up to 55%.