Your conflict-free student loan benefit and financial wellness platform.

Hire and retain employees by offering Vault Pay, Vault 529, Vault Match, and Vault Tuition Reimbursement benefits. Vault helps employers contribute secure, easy-to-track student loan contributions, 529 contributions, and tuition benefits to your employees. Fully-customizable plans and on-demand employer dashboards let employers track the real-time benefits of each program.

Contact Vault Sales.

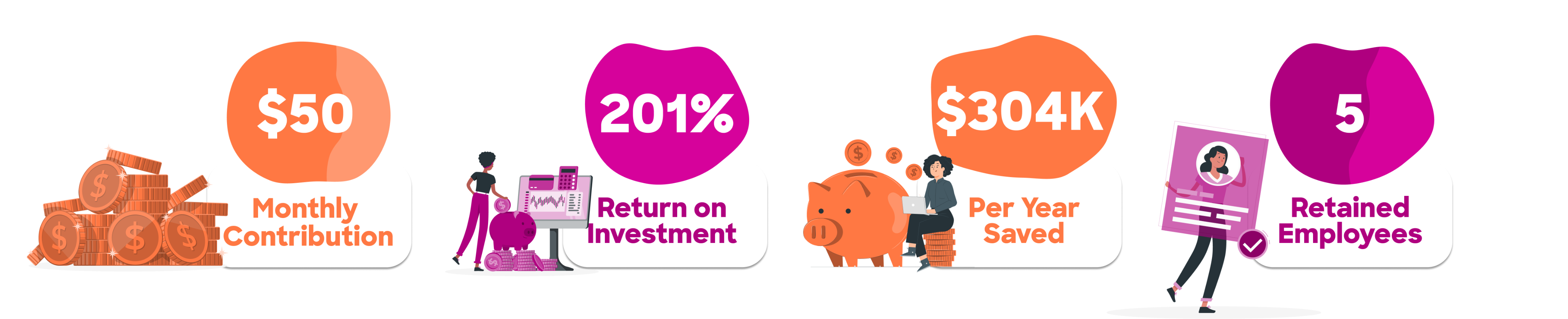

No minimum company size requirements. Low monthly fees.

Want to see Vault in action? Submit your contact information below and a Vault team member will email you to schedule a product demo for Vault Pay, Vault Match, Vault 529 and/or Vault Tuition Reimbursement.

The Vault benefits platform is SSO-friendly and offers optional APIs and customized programs.

Join over 1,750 employers already using the Vault educational benefits platform.

Employers can make $5,250 in tax-free contributions per employee until January 1, 2026.

Both employers and employees save on federal payroll taxes on qualifying payments.

What can Vault do for you?

Are you a mission-driven product person? We’re hiring in sales, development, and corporate. Send a current CV to hello@vault.co.

Vault corporate values separate us from the pack. We’re passionate about making a difference in employees’ financial lives. Think we should know each other? Say hello@vault.co.